Bitcoin falls after Coinbase debut, Venmo offers crypto, and NFTs explode

Hey Redpill Readers!

Following Coinbase’s flashy Nasdaq debut, the crypto market has had a pretty rough few weeks. What caused it? Keep reading. We've got you covered.

Bitcoin (BTC), the world’s largest cryptocurrency, is hovering around $50,000 right now. Plus, Venmo is getting into the crypto game. And non-fungible tokens (NFTs) are making it mainstream. Don’t know what those are? Don’t worry.

Today, we'll break everything down for you.

BITCOIN FALLS AFTER COINBASE DEBUT

"Coinbase is the leader here in building this new financial system. It's evolved to a point where there's no turning back," said Ross Gerber, CEO at Gerber Kawasaki Wealth and Investment Management.

And truth is, he's right. It was a big moment for the crypto industry. In fact, what we just saw was a shift in finance (as we get to know an entirely new set of leaders).

But the real question is: why the retreat in Bitcoin and crypto prices?

Well, there have been blackouts in China, which have led to mining issues. And then there's been investor jitters over Biden’s plan to nearly double capital gains taxes.

That’s why one investment manager has even warned of Bitcoin being “very frothy,” and believes that it could pull back even more to the $30,000 price level.

THE TAKEAWAY

Be cautious. And don't risk more than you can afford to lose. The crypto market is very volatile. But for those that are new to the space, don’t panic.

Price drops like what we're seeing right now are normal.

Hold onto your Bitcoin... and weather the storm. Just be informed about why things have spooked some investors.

Here are the main reasons:

A U.S. Treasury Department report going after crypto money launders

An upcoming ban in Turkey on using cryptos as currency

Misinterpreted insider sales of Coinbase equity ($COIN)

A few whales are liquidating some of their BTC holdings

Plus, important Chinese bitcoin miners have suddenly gone offline

And one analyst, Willy Woo, says the Chinese coal mining accident was a big reason as to why there's been a violent drop in Bitcoin's hashrate (and overall price).

This event, plus the electricity outage in China's Xinjiang region, may have reduced the Bitcoin network's processing power by 19%.

What does that ultimately mean?

It means the whole thing may have exposed Bitcoin's heavy dependency on coal-driven energy. But fear not, things are changing…

In fact, here's what you can expect long-term: Decentralized micro-energy sources for Bitcoin mining!

Tesla already has its hands in the cookie jar. And by that, we mean the company's ability to sell solar panels, solar roofs, and batteries.

It's all about energy, folks.

This kind of system Tesla is creating will be able to feed surplus energy into the power grid. Yes, the same one that froze over in Texas earlier this year.

Tesla Powerwalls can store surplus energy and power various things in your home, including air conditioners, appliances, devices, electric vehicles (EVs), and much more.

But here's the best part: The excess energy from Tesla’s micro-energy sources can be rerouted to run crypto mining operations.

Neat, right? Without crypto mining, the surplus energy is either wasted or stored (and sold for pennies on the dollar).

But now, with Tesla expanding into the power market, along with other energy companies, they'll be able to turn stranded energy, or excess power, into a digital asset, like Bitcoin. Something of value.

Something that's instantly bankable.

In other words, the future is full of energy (and very bright).

Moving on...

VENMO JUMPS IN WITH BOTH FEET

Venmo became the latest company to embrace cryptocurrency, joining the ranks of payment service providers PayPal (Venmo’s parent company) and Square, all of whom are taking crypto mainstream.

If you haven’t heard, Venmo will support a few cryptos. A few popular ones like: bitcoin, ethereum, litecoin and bitcoin cash.

THE TAKEAWAY

The Venmo app will let the customers get started with as little as $1.

But that's not all. Venmo has also created a series of educational videos. Helpful videos to explain some of the basic concepts behind crypto and blockchain.

You can look it up on its website and within the app.

This is great news for mainstream adoption. Bitcoin is spreading. And the fact that you're reading this means you're ahead of the herd.

Next up...

NON-FUNGIBLE TOKENS (NFTs) ARE MAKING A SPLASH

NFTs rely on blockchains to prove they're scarce, a necessary attribute of digital trading cards, works of art, and other collectibles.

Each one is unique, too. Which is why many experts believe that NFTs will be one of the significant growth vectors in crypto throughout 2021.

As an example, digital artist Mike Winkelmann — known as “Beeple” on social media — sold 20 of his digital art for more than $3.5 million.

NFTs represent a bunch of different items, including artwork and game collectibles from organizations such as the National Basketball Association (NBA).

But first, who is Dapper Labs? They’re responsible for the high-flying digital collectibles platform NBA Top Shot. They recently raised funds that should net the firm more than $250 million at a valuation of about $2 billion.

In fact, NBA Top Shop project is probably the most popular non-fungible token (NFT) series by volume after being launched in October of last year. And guess what? The firm has generated about $100 million in NFT sales.

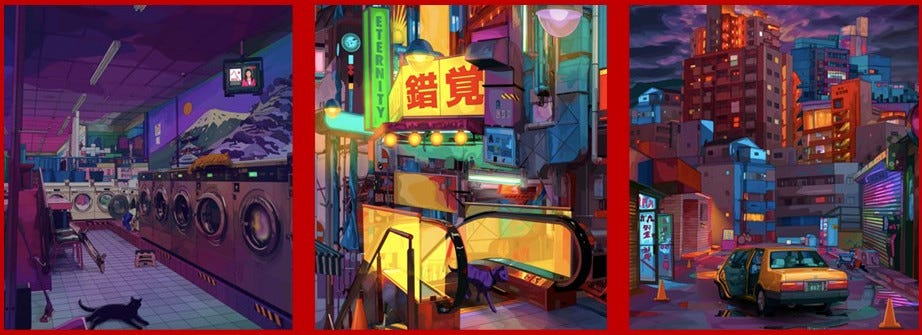

And get this, another digital artist named Mad Dog Jones broke an NFT record by selling $4 million worth of tokenized animations of his Tokyo artwork in just 9 minutes on Nifty Gateway (another popular NFT platform).

Here's what some of his artwork looks like...

THE TAKEAWAY

For everyday folks, NFTs make the internet ownable. The “Creator Economy” and NFTs are a big deal. Even if many of these assets are in a bubble, we're on a march towards individuals mattering more than institutions. And that’s very exciting.

MORE REDPILL CRYPTO NEWS

TIME magazine reportedly holds Bitcoin on balance sheet

Why crypto is coming out of the shadows – Morgan Stanley

Billionaire Daniel Loeb’s hedge fund investing in crypto

Chainlink and Polkadot referenced in report by European Central Bank

Candidate for mayor Andrew Yang plans to make New York City a bitcoin hub

WeWork officially accepting crypto as form of payment

Crypto giant Binance.US hires former bank regulator, says WSJ

Jack Dorsey’s Square and Cathie Wood's Ark suggest Bitcoin mining encourages the adoption of renewable energy – Business Insider

Citi on the future of money - Crypto, CBDCs and 21st Century Cash

DISCLAIMER: Newsletters published by Redpill Crypto Research reflect the opinions of only the editors who are associated persons of the firm and do not reflect the views of anyone else. They are meant for informational purposes only, are not intended to serve as a recommendation to buy or sell any security in a self-directed account with Coinbase Inc. or any other account, and are not an offer or sale of a security. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns. Cryptocurrencies and digital assets are speculative and highly volatile, can become illiquid at any time, and are for investors with a high risk tolerance. Investors could lose the entire value of their investment.

Redpill Crypto Research will have no liability whatsoever for any expenses, losses (both direct and indirect) or damages arising from, or in connection with, the use of information in this newsletter. Readers are encouraged to conduct their own research and due diligence, or obtain professional advice, prior to making any investment decision.© 2020 Redpill Crypto Research. All Rights Reserved.