Coinbase Going Public, XRP Punched In The Mouth, No Whale Sell-Offs

Hey Redpill Readers!

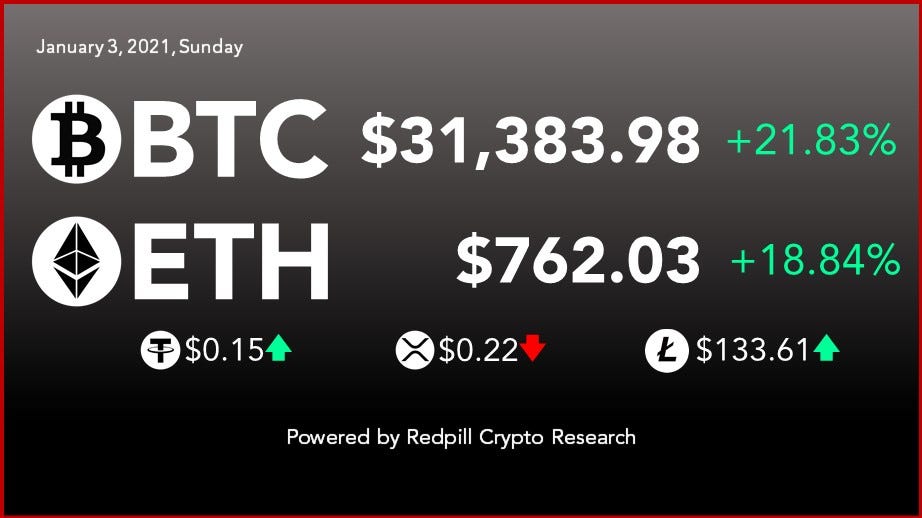

We just entered 2021 and BTC has already hit new all time highs surpassing the $30k mark (and beyond). But before we touch on that...

Let’s analyze and take a look at the crypto market.

From XRP trading suspensions to new BTC price predictions.

Let’s get to it…

BIGGEST US CRYPTO EXCHANGE IS GOING PUBLIC

Coinbase announced earlier this month that it confidentially filed a draft registration statement for an initial public offering (IPO) with the Securities and Exchange Commission (SEC).

Quick info: Founded by CEO Brian Armstrong, Coinbase has become the largest crypto exchange in the US. The trading platform has more than 35 million users around the world buying and selling cryptocurrencies.

What happens if Coinbase goes public? Simply put, it can sell shares to the public which means it can raise capital from investors.

If approved, Coinbase would be the first major cryptocurrency exchange in the US to go public. This would be huge for the crypto industry.

The announcement of Coinbase comes at a time when Bitcoin broke out past the $20k mark. Now, it’s past $30k.

Nice timing.

THE TAKEAWAY

Well…

It’s always a two-way street.

Going public would help Coinbase raise capital. And massively expand its ventures with the cryptocurrency market.

In other words…

The cryptocurrency industry would go much, much further with mainstream adoption. No doubt about it.

But an IPO also brings Coinbase and its crypto ventures closer to strict scrutiny considering it’s being approved and regulated by the SEC.

Looking forward: What’s on our mind is whether the Coinbase IPO application involves a blockchain – in the form of a digital token. If it does, that would be real big for the crypto industry.

Moving on…

CRYPTO EXCHANGES SUSPEND XRP TRADING AS PRICE FALLS FURTHER

Major crypto exchanges, including Coinbase, are suspending XRP trading as price falls more than 30% following the SEC nasty lawsuit against Ripple, Inc., the company issuing and managing XRP. It’s also a hit against two executives for allegedly selling $1.3 billion unregistered securities.

Bad times for XRP.

Here are the major trading platforms that announced an XRP trading suspension:

Coinbase, a major crypto currency exchange, announced recently that it will suspend XRP trading on January 19, 2021 due to SEC lawsuit against Ripple. But users may still deposit and withdraw from their XRP wallet.

OKCoin also released notice of suspension for XRP trading and deposits in its platform following news of SEC lawsuit. Starting January 4, 2021, users can no longer trade and deposit XRP on OKCoin.

Bitstamp, a Luxembourg-based crypto exchange, also announced a halt to XRP trading and deposits for users in the United States also because of the SEC lawsuit.

OSL, a Hong Kong based crypto exchange, also suspended XRP trading and payment services until further notice.

The result? XRPprice crashed 25% after the filing of the SEC complaint.

And it fell more than 30% after big crypto exchange Coinbase announced the suspension of XRP trading on the platform.

Ouch.

THE TAKEAWAY

Indeed, this is a worrying development.

As big exchanges like Coinbase suspend XRP trading and deposits, minor crypto exchanges would likely also delist XRP from their platforms.

This puts XRP in a difficult place…

And according to many analysts, XRP’s price is expected to sink considering the sell-off triggered by the FUD caused by the SEC lawsuit.

So, what’s next?

Too early to guess. A quick chart analysis from our firm does little help since the drop is more of investors’ sentiment (at this point in time).

But there is some good news for XRP holders… all of this may change depending on how Ripple responds to charges and how the SEC plays its cards. Will we see a slap on the wrist? A small fine?

Time will tell.

But still, it could be a challenging road to recovery for XRP.

Meanwhile…

WHALES BUYING MORE BTC DESPITE THE PRICE SURGE

Whales are buying more Bitcoin rather than selling them amidst the bullish rise of BTC price. On chain data shows...

Wealthy investors continuously buying BTC since the holidays.

Says who?

Santiment, a behavior analytics platform for cryptocurrencies.

According to its report, BTC worth roughly $647 million were transferred from small addresses to large addresses.

Here’s what Santiment said:

“Over the last 48 hours since Christmas, #Bitcoin addresses with 1,000 or more $BTC now own 0.13% more of the supply that smaller addresses did previously. This is about 24,158 tokens, which translates to $647.7M at the time of this writing.”

Keep in mind: Accounts with 1,000+ BTC are treated as whales considering Bitcoin has hit new all time highs of $30k.

CryptoQuant CEO Ki Young Ju also tweeted that “BTC whales seem exhausted to sell.” And we agree.

He also noted that “fewer whales are depositing to exchanges.”

Concluding that BTC price surge will continue “as institutional investors keep buying and [as the] Exchange Whale Ratio keeps below 85%.”

THE TAKEAWAY

It looks like whales continuously hodl and increase their BTC portfolio despite the price hike. But why?

Analysts say it might be for two reasons:

A positive outlook for a BTC price break-out… Passing the $30k mark sets the new short-term of $35k as the next target.

No significant price correction is being seen as of now… BTC price has been bullish over the past days. And no major resistance has been noted. But that could quickly change.

The thing is… whales can influence the BTC market price to either dip or rise when whale traders buy or sell crypto in large volumes.

So, it’s better to look out for the whales’ activities as they somehow open opportunities to buy low and sell high.

For now, hodl on and stay tuned…

BTC HITS NEW ALL TIME HIGH AT $30,000

Bitcoin (BTC) passing $30,000 and hitting highs of near $31,000 has caused a lot of pain for traders betting on a bearish pullback.

Max Keiser recently said Michael Saylor, the CEO of MicroStrategy, is planning a George Soros “break the bank” move with Bitcoin.

For those unfamiliar with this story…

In the world of economics and finance: Soros is known as “the man who broke the Bank of England” when he made $1 billion in one day, September 16th, 1992 (known as Black Wednesday).

We’re talking about an institutional player with the ability to go large and make or break a currency. Literally.

It’s a crazy, yet true story.

But what Michael Saylor is trying to do with buying Bitcoin (and using low cost finance) compared to Soros’ attack on the British Pound, you start seeing every single current asset bubble that way.

In other words? All bets are against the central bankers.

THE TAKEAWAY

And as the Fed continues to lower interest rates... we see Bitcoin and cryptos as a one-way bet with no top. As for BTC price?

Analysts previously set $30,000 as the mark to break for BTC to record new all-time highs. And BTC did just that.

If you don’t have any BTC yet in your portfolio, there’s still time.

Get some, even fractions of it.

We highly encourage our readers to do so as it’s an asymmetric bet with big, big upside. It’s also built on strong principles which many of you already know as you’re an early investor and redpill crypto subscriber.

Just remember...

"If you're [still] looking for an entry to HODL Bitcoin long term, don't nickel and dime an entry. You're not going to sweat a few thousand dollars of non-perfect entry when it's $100k,$200k,$300k in a year," popular statistician Willy Woo summarized.

So, good days ahead for BTC maximalists and hodlers.

If the crypto market keeps its current pace, data suggests that the BTC price will break out past the $35k milestone next.

The truth is, Bitcoin marks the beginning of a new future and a new monetary standard. And that is revolutionary.

“The present is theirs; the future, for which I really worked, is mine.” - Nikola Tesla, Serbian-American inventor and futurist

DISCLAIMER: Newsletters published by Redpill Crypto Research reflect the opinions of only the editors who are associated persons of the firm and do not reflect the views of anyone else. They are meant for informational purposes only, are not intended to serve as a recommendation to buy or sell any security in a self-directed account with Coinbase Inc. or any other account, and are not an offer or sale of a security. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns. Cryptocurrencies and digital assets are speculative and highly volatile, can become illiquid at any time, and are for investors with a high risk tolerance. Investors could lose the entire value of their investment.

Redpill Crypto Research will have no liability whatsoever for any expenses, losses (both direct and indirect) or damages arising from, or in connection with, the use of information in this newsletter. Readers are encouraged to conduct their own research and due diligence, or obtain professional advice, prior to making any investment decision.© 2020 Redpill Crypto Research. All Rights Reserved.